dependent care fsa vs tax credit

How to choose between. The IRS limits the total amount of money you can contribute to a dependent-care FSA.

What Is A Dependent Care Fsa Wex Inc

Perhaps more importantly you have money set aside for medical expenses both planned and unplanned.

. For saving 2850 in a FSA youll reduce your tax liability by 342. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for. Learn how the grace period works on a flexible spending account so you can take full advantage of your annual pretax contributions.

What Is A Dependent Care Fsa Wex Inc

Coronavirus And Dependent Care Fsa H R Block

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

How Does A Dependent Care Fsa Work Goodrx

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

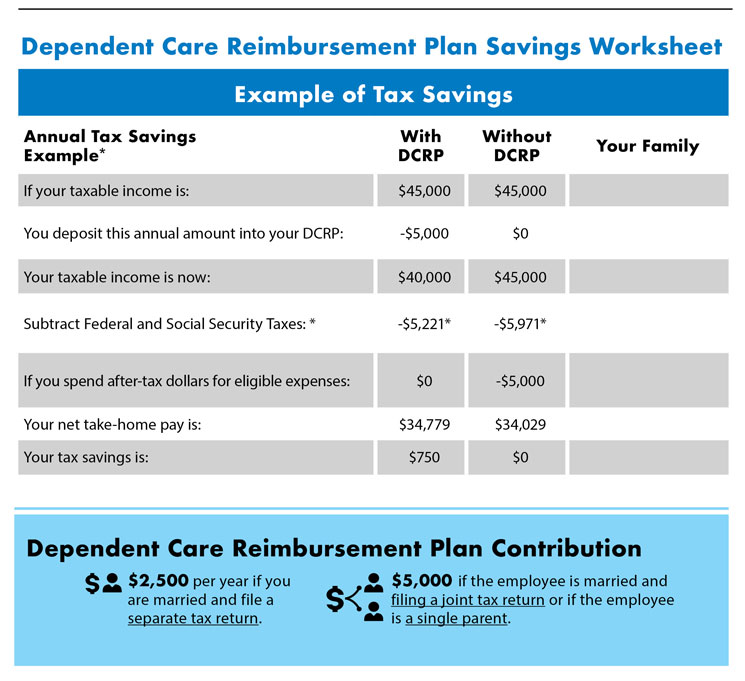

Coh Dependent Care Reimbursement Plan

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning